By Emmanuel Ado

“The essence of government is power; and power, lodged as it must be in human hands, will ever be liable to abuse”. -James Madison

The Nigerian economy is predominately cash-based with a huge informal sector relying heavily on cash transactions. In 2022 the Central Bank of Nigeria (CBN), announced its commitment to making Nigeria 100 percent cashless. That was much appreciated but it came without adequate preparation.

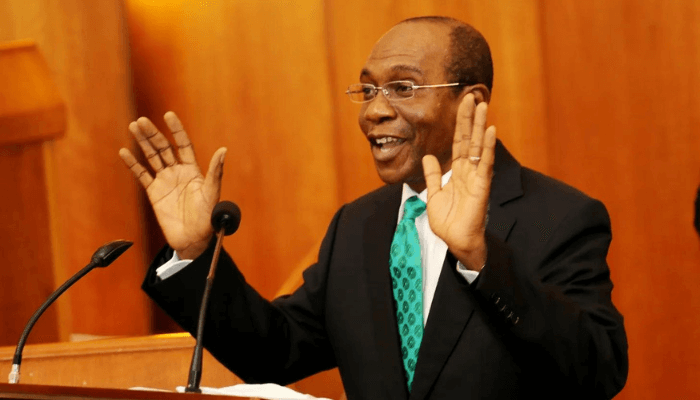

Mr. Godwin Emefiele the embattled Governor of the CBN had said “the destination is to achieve 100 per cent cashless economy in Nigeria. I know that those who doubt us will say that 100 per cent cashless is unattainable. Yes it is true, but Nigeria must move from being a predominantly cash economy to a predominantly cashless economy”. However, Emefiele’s optimism was not shared by many informed analysts going by the reality of the Nigerian situation and the failure of a similar policy by India in 2016.

Anthony Osae Brown and Emele Onu, in a December 14th article published in Bloomberg titled “Why Nigeria Is Clamping down on Its Vast Cash Economy”, wrote: “Cash is the lifeblood of Africa’s biggest economy and there is concern that the switchover could trigger the kind of chaos that broke out when India tried something similar in 2016″. A very prophetic statement that, had the CBN listened to, the outcome would have been better.

The argument by Osae-Brown and Onu is based on the fact that an estimated 85 percent of the local currency was outside the banking system and that well over 90 percent of transactions are made using cash. The other reasons the policy would fail include the fact that Nigeria has only four to five bank branches for every 100,000 people. Worse still, is that half of the estimated 230 million population have no bank account, a combination of factors that would make mopping up the over N2.7 trillion, a very difficult exercise. And the more difficult part is ensuring the availability of the new notes.

What Bloomberg did not add was the infrastructural deficits -the poor power supply and the internet connectivity challenges- that would further make the realization of the goals unattainable.

Given this scenario, it, therefore, presupposes that the currency redesign policy to usher in a cashless economy ought to be implemented in a manner that the citizens, who are yet to recover from the Covid-19-induced recession, are not subjected to further untold hardship. The reasons for well a phased implementation strategy cannot be over-emphasized. Nigeria is notorious for its poor infrastructure, epileptic public power supply and inefficient telecommunications infrastructure, which are critical to drive the cashless economy.

The other challenge the policy faces is the mistrust in some aspects of the cashless economy that have been implemented. For instance, fraudsters have been defrauding businesses and citizens, which has greatly affected confidence in the cashless regime, especially transfers. It is only in Nigeria that one hears of “fake transfer alerts”. Therefore, without the necessary protection by the CBN, the confidence of citizens in the cashless economy will continue to be zero.

The failure of CBN to factor in these real challenges and its decision to opt for an immediate implementation opened it up to charges of driving a political agenda and not an economic policy. CBN cannot deny the allegation. In implementing the policy, the CBN has behaved more like a conquering warlord, especially as the banks who risk having their licenses revoked, lack the “liver” to question it.

As predicted by Bloomberg and other informed analysts, the immediate fallout was chaos at the cashless ATMs in an economy that has tanked. Customers are spending precious time trying to withdraw cash for various purposes because while the CBN had withdrawn N2.7 trillion from the economy, it printed only N300 billion. Without a doubt, millions of people have incurred huge financial losses, and the worst hit is poor.

It must be stressed that the though the policy is right, the problem is that it’s very poorly implemented. And as with every poor implementation of a policy, no matter how “well-intentioned”, there are bound to be repercussions. Once the dust settles, the banking system will certainly lose some disenchanted customers, and those the CBN policy forced into the financial system, will without hesitation, turn their backs on the banks out of real worry.

Unfortunately, the very political Emefiele, who will go down in history as the worst Governor of the CBN, has no response to turn around the economy which is already in crisis, due to several other factors, including declining oil output and the unsustainable import of petroleum products.

Nigeria has not and is clearly not willing to deliver a better life for its people. This explains the jackboot implementation of the policy, and why despite creating so much havoc, the forces behind it have refused to allow the old and new naira notes to co-exist.

The International Monetary Fund (IMF), has taken an unprecedented step of calling for extension of the deadline. In a statement, the Fund stressed: “In light of hardships caused by disruptions to trade and payments due to the shortage of new banknotes available to the public, in spite of measures introduced by the CBN to mitigate the challenges in the banknote swap process, the IMF encourages the CBN to consider extending the deadline, should problems persist in the next few days leading up to the February 10, 2023 deadline,” Ari Aisen, the Fund’s Resident Representative to Nigeria, said in a statement on Wednesday.

It is estimated that 23 million Nigerians are living in extreme poverty. That is a number that’s expected to substantially increase due to inflation caused by the high cost of petroleum products, an increase in the cost of basic items, and an unsteady revenue flow that has made payment of salaries difficult.

The Nigerian National Petroleum Corporation (NNPC), which has, in the last two years, continuously refused to remit any money to the foreign reserve and the Consolidated Revenue Fund, and the payment of over 7 trillion naira subsidy, has scandalously failed to make petroleum products available.

Though Emefiele alluded to the failure of the Indian experiment, he clearly failed to learn from the Indian experiment, which affected over 1.5 million jobs. If he did, it would have guided the CBN in implementing the cashless policy. Because the bank operated in isolation, without the input of critical stakeholders, including the mint, the country is on edge with innocent bankers being made scapegoats for a badly implemented policy.

Emefiele epitomizes the saying that power tends to corrupt and absolute power corrupts absolutely. The damage to the economy by his actions is unquantifiable. Critics have every right to tag the cashless policy a political one, not only because Emefiele committed the sacrilege of running for the presidency at the behest of the Villa forces while holding on to the CBN job, but because he bluntly made it clear that he wanted to stop vote buying.

Thankfully, Kaduna, Kogi, and Zamfara state governments, by approaching the Supreme Court to adjudicate on the policy have bailed out suffering Nigerians. And to the relief of every Nigerian, the Supreme Court eased the tension by directing that both the old and new currencies continue to be legal tenders thus bringing some temporary relief to the untold hardship Nigerians have had to endure since the introduction of the policy.

The four main issues that the state governments formulated for the trial are; whether the demonetization policy of the Federation viz: the withdrawal of the old N1000, N500 and N200 Bank Notes being carried out by the Federal Government of Nigeria through the Central Bank of Nigeria, under the directive of the President of the Federal Republic of Nigeria is in compliance with the provision of the Constitution of the Federal Republic of Nigeria 1999 (as amended), Central Bank of Nigeria Act, 2007 and the extant laws on the subject?

The second, is whether the 3-month notice given by the Federal Government of Nigeria through the Central Bank of Nigeria under the directive of the President of the Federal Republic of Nigeria, the expiration of which the old Bank Notes shall cease to be a legal tender, satisfies the provision of Section 20(3) of the Central Bank of Nigeria Act 2007 which specifies that “Reasonable Notice” be given by the Central Bank before it can call in its banknotes and after which same cease to be legal tender?

The third is whether the demonetization policy of the Federation viz: the withdrawal of the old N1000, N500, and N200 Bank Notes being carried out by the Federal Government of Nigeria through the Central Bank of Nigeria, under the directive of the President of the Federal Republic of Nigeria, does not directly interfere with the powers and functions of the Plaintiffs and the welfare of the citizens of the Plaintiffs’ State? And lastly, Whether, in view of Section 20(3) of the Central Bank of Nigeria Act, the Federal Government of Nigeria through the Central Bank of Nigeria under the directive of the President of the Federal Republic of Nigeria have the powers to give a timeline for the redeeming any of its banknotes and the expiration of which timeline entitles the Bank to refuse to redeem same?

And that upon the determination of the foregoing questions for determination by the Supreme Court, the court should urgently grant the following reliefs: A declaration of the Demonetization Policy of the Federation being currently carried out by the Central Bank of Nigeria under the directive of the President of the Federal Republic of Nigeria is not in compliance with the extant provisions of the Constitution of the Federal Republic of Nigeria 1999 (as amended), Central Bank of Nigeria Act, 2007 and extant laws on the subject.

“A declaration that the three-month Notice given by the Federal Government of Nigeria through the Central Bank of Nigeria under the directive of the President of the Federal Republic of Nigeria, the expiration of which will render the old Banknotes inadmissible as legal tender, is in gross violation of the provisions of Section 20(3) of the Central Bank of Nigeria Act 2007 which specifies that Reasonable Notice must be given before such a policy.

“A declaration in view of the express provisions of Section 20(3) of the Central Bank of Nigeria Act 2007, the Federal Government of Nigeria through the Central Bank of Nigeria has no powers to issue a timeline for the acceptance and redeeming of banknotes issued by the Bank, except as limited by Section 22(1) of the CBN Act 2007, and the Central Bank shall at all times redeem its bank notes.

“AN order of this Honourable Court directing the immediate suspension of the demonetization policy of the Federal Government of Nigeria through the Central Bank of Nigeria under the directive of the President of the Federal Republic of Nigeria until it complies with the relevant provisions of the law.”

When on the 15th February 2023 the parties return to court, with some more states like Rivers, Ondo, and Kano, joining in the matter, the hope of Nigerians, is that the court will do justice, going by the admittance by the Nigerian Minting Company that it lacks the capacity to print more notes. And the hope is there that it would, going by the ruling by Justice Okoro, “the court finds that there is a real urgency for this court to intervene”, which explains why it had no hesitation granting the ex-parte application.

The next few days will determine whether the country will continue on the path of doom that it is presently heading. By badly handling the policy, the government’s plan to deal corruption a major blow and to entrench a 100 percent cashless world has spectacularly failed. And refusal by the forces of darkness to sensibly manage the implementation will definitely compound the already bad situation and might threaten the 2023 elections.

Postscript: India and Nigeria, are guinea pigs for other countries that want to tackle black money or promote a cashless economy.