These are not the best of times for the governor of Taraba state, Lt. Col. Agbu Kefas. His decision to take the sum of N500 billion bond from the capital market is rearing to tear his government apart. This is because he is alleged to have refused to tell people of the state whet he did with the N206,776,000.00 (Two hundred and six billion, seven hundred and seventy-six million) he earlier borrowed from four commercial banks to “execute projects.” The people say he is yet to show evidence on what he used the N206.7 billion for.

The opposition in Taraba, and critical stakeholders, have asked the governor to come clean before the people how he spent the over N206 billion that he borrowed from a consortium of banks including Zenith Bank, UBA, Fidelity Bank and Keystone bank for which he mortgaged income to the state from the Federation Account Allocation Committee (FAAC), Joint Account Allocation Committee (JAAC), Internally Generated Revenue (IGR) and Value Added Tax (VAT) as security.

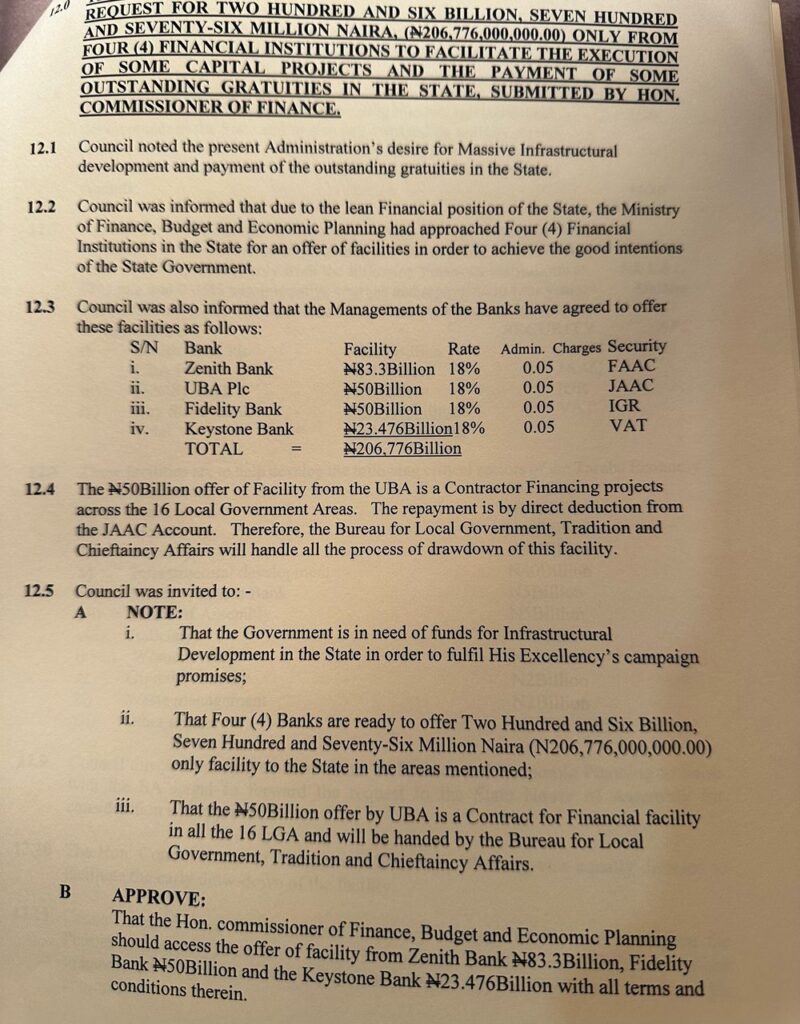

The N206.7 billion was said to be for the “execution of some capital projects and the payment of some outstanding gratuities in the state.” Request to take the loan was made on behalf of the governor by the state commissioner for Finance, Sarah Enoch Adi, before the state Executive Council which also approved it without a detailed list of projects to which the loan is attached.

According to a memo from the State Executive Council, the N206.7b was borrowed from Zenith Bank N83.3 billion; UBA Plc N50 billion; Fidelity Bank N50 billion and Keystone bank N23.76 billion. All the amounts were released to the state government at 18 per cent interest rate by the commercial banks.

The State Executive Council document permitting the loan further stated that “the N50 billion offer by UBA is a contract for financial facility in all the 16 LGA and will be handed by the Bureau for Local Government, Tradition and Chieftaincy Affairs.”

Some voices in the state said the loan which was fully drawn has not had any impact on the state as civil servants are owed several months in unpaid salaries while pensions and gratuities remain unpaid too. They also said that expectations that the loan would accelerate development projects in the state capital, has vanished as despite promises by Gov Kefas to transform the capital city, Jalingo is still the old village that it used to be.

Meanwhile, while the people in the state are still asking to know how the N206.7 billion was spent, the State Executive Council approved another request by the Finance commissioner to permit the sourcing of an additional N00 billion bond from the capital market.

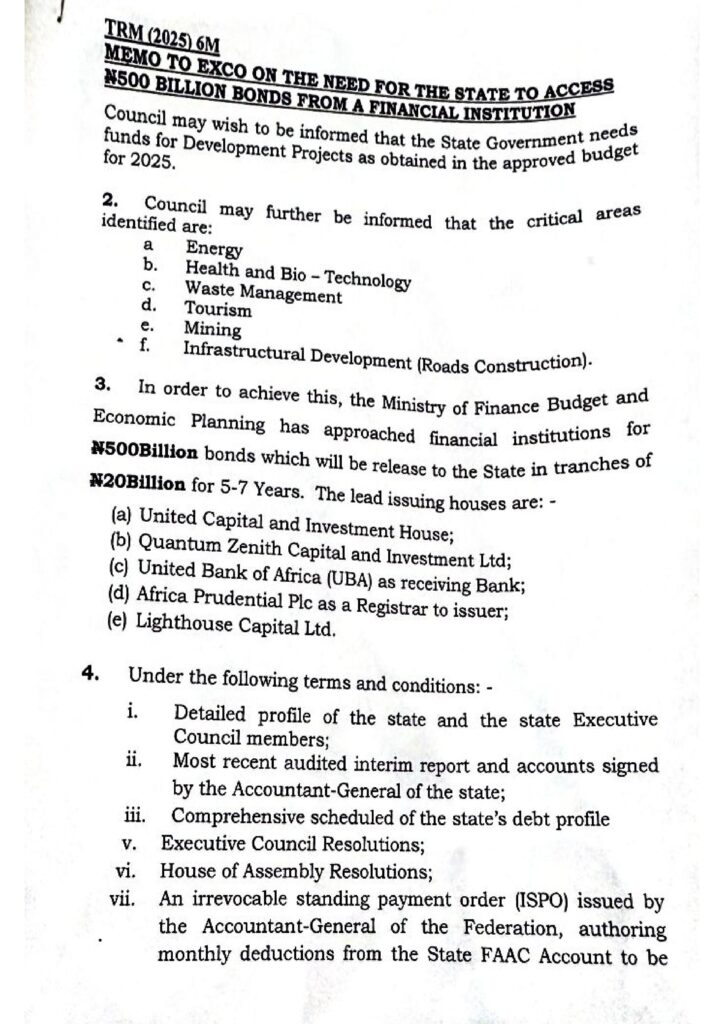

A memo titled “Memo to Exco on the need for the state to access N500 billion bonds from financial institution,” stated that the state government “needs funds for development projects as obtained in the approved budget for 2025.”

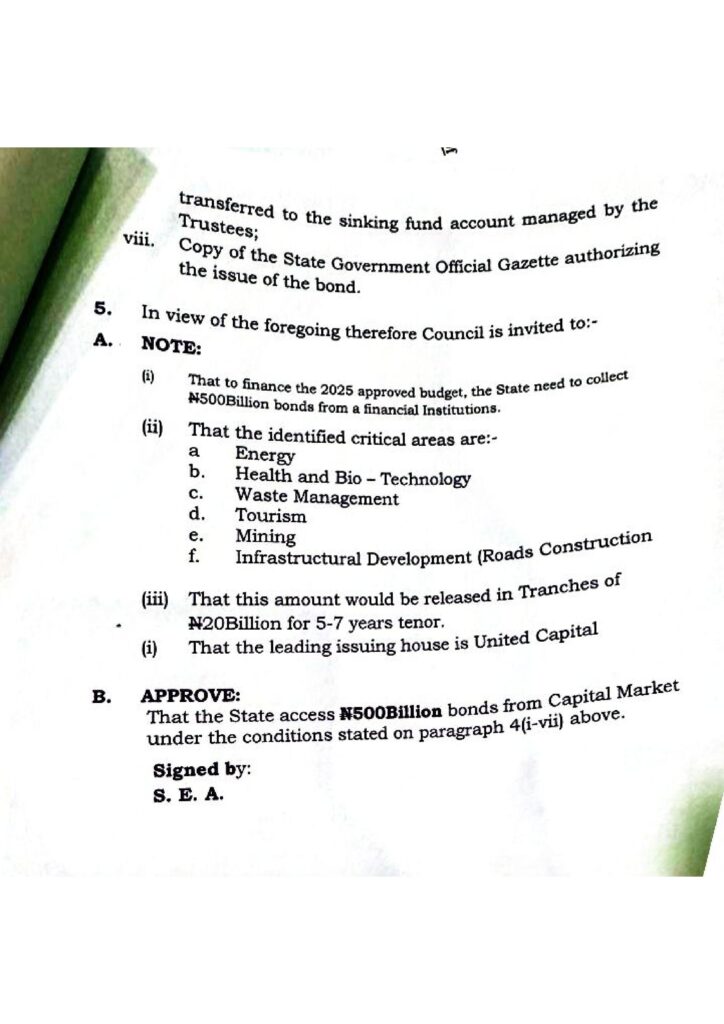

Though the specific projects for which the N500 billion bond is now sought were not listed in the memo as presented by the Finance Commissioner, the state executive council gave approval that the bond be sourced from the capital market.

According to the State EXCO Memo, issuing houses for the bond are United Capital and investment House, Quantum Zenith Capital and Investment Ltd, United bank for Africa (as receiving bank) Africa Prudential Plc as registrar to issuer and Lighthouse Capital ltd. United Capital would be the lead issuing house.

The Commissioner for Finance said the N500 billion “will be released to the state government in tranches of N20 billion for -7 years tenor,” while there will be an “irrevocable standing payment order (ISPO) issued by the Accountant General of the Federation, authoring (authorising) monthly deduction from the state FAAC Account to be transferred to the sinking fund account managed by the trustees.

Opposition to the N500b bond is rising. And it is based on the fact that it is not tied to any particular projects. It is argued that the listing of “energy, health and bio technology, waste management, tourism, mining and infrastructural development’ as reasons the state is going for the bond, are rather general terms that do not refer to no particular projects that would help the people to benchmark the spending of the funds.

Besides, there are indications that the state government abandoned a project financing negotiations with Afreximbank, African Development Bank and ECOWAS Bank for Investment and Development midway, because of the strict conditions attached to the finances which were to ensure transparency and accountability.

Checks at the above development finance institutions (DFI’s) indicate that their funds are project-tied. This means that whatever funds they release to states, which are with single digits interest options, must be tied to specific projects unlike those of commercial banks. The DFI’s also graduate their financing for projects so as to track judicial use of allocated funds.

Documents on the deal indicate that the Taraba state government had through an investment bank, sought the assistance of Afreximbank, AFDB and ECOWAS bank for the funding of some critical developmental projects. These include an Integrated rice project which will consist of a 16 ton rice mill and 10,000 hectares of rice farm located in Governor Kefas’ home local government area, as well as a solar and hydro energy project which would guarantee the generation of 50mw of energy from solar and 30mw from hydro for consumption in the state, and the creation of an industrial park which was designed to have five clusters. These are agro processing clusters, mineral beneficiation cluster, logistics cluster, residential and commercial housing cluster and general industry cluster which has an eye on Asian investors.

Investigations indicate that one of the DFI’s had readied an investment package of about $82 million into the Integrated Rice Project which would create more than 1000 jobs with the rice farm designed to produce improved rice varieties on a three-yearly cycle with improved irrigation.

The opposition said they were abandoned for fear that the strict transparency and accountability governance of the DFI’s would make misappropriation of the funds difficult. According to those in the Gov. Kefas government who have details of the abandoned negotiations with DFI’s, the bank loans and bond can be easily misappropriated and they do not have strict transparency compliance rules.

However, Emmanuel Bello, Senior Special Assistant on Media to the governor, responding to similar allegations, had told nationalupdate.ng that the claims were untrue. Though he said that Taraba was still liquid enough to fund its financial obligatins, he said “Our IGR has iproved considerably due to the hard work of the sagacious governor and his team. This is the year of infrastructural development in roads and bridges. Our 2025 budget reflect this commitment.”

Join the Conversation