By Chigozie Ogbuagu

Despite assurances by Abubakar Malami (SAN), Attorney General and Minister of Justice, that the Central Bank of Nigeria(CBN), will consequent upon the ruling of the Supreme Court, extend the deadline for the old naira notes from 10th February to 15th February 2023, the governors of the 36 states and many Nigerians knew, they were determined to ignore the ruling.

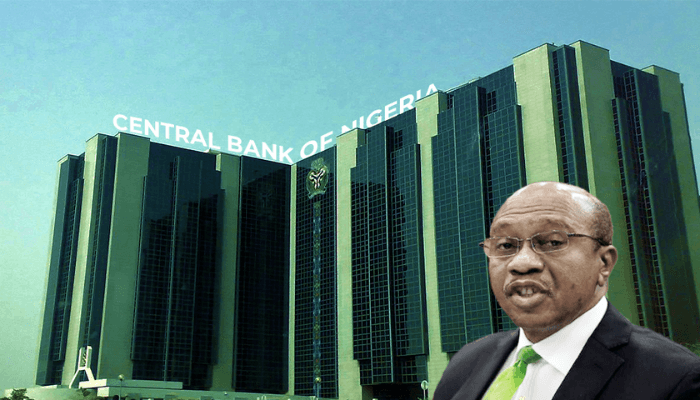

Whatever doubts about the government’s intention not to obey the Supreme Court decision and its lack of sincerity on the matter, were rudely cleared by Haladu Idris Andaza, Branch Controller CBN, Bauchi. He is quoted to have said, “old notes are no more legal tenders in Nigeria from the 10th of February, 2023”. Andaza, like Godwin Emefiele, the CBN Governor, is caught in what is clearly high-stakes politics that is tied to the 2023 presidential elections.

Against this background Nigerians are waiting for the outcome of the proceedings at the Supreme Court, as the Attorneys General of Kaduna, Kogi, Zamfara, and the other states battle to convince the apex court, not only to permanently push back on the rushed currency swap of the Central Bank of Nigeria which has driven the country to chaos and the fringes of anarchy but on how it reacts to the effrontery of the bank.

On the opposite side, Malami (SAN) will make every effort to get the apex court to quash the suit on technicalities, on the grounds that the CBN was not joined, and cannot be made a party to any suit before the court of first and last instance.

The eventual pronouncement of the highest court will determine whether the ominous clouds over the land would disperse, or the nation would sink deeper into the quicksand of anarchy, which clearly will help those forces working towards postponement of the election or the constitution of an interim government.

No sensible person will question the authority of the Central Bank to redesign the national currency at any time it deems fit. Section 2(b) of the CBN Act 2007 clearly mandates it to be the sole issuer and custodian of legal tender in the country. It is empowered to regulate the volume of money supply in the economy in such a manner as to ensure monetary and price stability. To achieve its goal, the apex bank and industry regulator is further empowered to procure, distribute, process, redesign, re-denominate, reissue, and dispose of banknotes and coins, as it deems.

But, in the discharge of its duties, the law did not anticipate that the CBN managers would inflict unspeakable pain on the citizenry, create unprecedented chaos, disrupt businesses and social life, threaten national political stability, especially the elections, that could lead to anarchy in the land.

This is why all right-thinking persons in the country must be worried, even as many are weeping loudly over the mismanagement of the ongoing currency re-designation exercise. They are dazed because the timing and methodology of the ongoing banknote re-designation exercise have brought unspeakable suffering to people in all strata of life across the country. What we are dealing with is a classic case of a good policy damaged by poor planning, inadequate consultation with critical stakeholders, wrong timing, and poor implementation.

Emefiele, who must have reviewed some recent cases of currency swaps in other countries like India, and our next-door neighbor, Ghana, didn’t show the benefits of such efforts. He surely knows that such high-impact economic exercises are never done in a hurry and that they can wreak havoc on fragile economies like ours, which remain grossly under-banked, heavily cash-based, and lagging behind in the area of electronic payment technology. It beats imagination why the CBN, egged on by some hawks around the seat of power in Aso Rock, believed that they could knock off a cash swap within three short months, without causing massive social and economic upheavals in the polity.

If Mr. Emefiele knows his onions, as we think he does, his acceptance to undertake a currency swap within such a restricted timeframe can only be blamed on undue politicization of what ordinarily should have been purely an economic policy. Though the CBN helmsman only plays up the economic side of the card, his backers at Aso Rock villa have never hidden their motive for ordering the re-designation of the national currency on eve of the general elections.

President Muhammadu Buhari himself has, on several occasions, lamented that some desperate politicians have stashed huge quantities of raw cash in their vaults, with which they plan to buy votes or otherwise influence the outcome of the elections in their favour. The president was sold a dummy that backing the policy will portray him as creating a level playing field for all contestants, which made him authorize the regime of currency change to frustrate those who hope to win elections through the monetary inducement of voters.

Granted, vote buying and undue monetization of elections ought to be condemned in strong terms, as they do not augur well for democracy. But a serious nation should figure out effective ways to curb the menace of vote-buying without strangulating its citizens with a killer monetary swap. It is not rocket science to arrest and prosecute anyone paying cash for votes or to sanction any candidates who exceed the limits of campaign spending. Rather than mandate the law enforcement agents to check vote-buying, our policymakers sadly chose the fatal path of haphazard currency swap, bringing unspeakable pain to the citizenry.

How did we get into the present quagmire? On October 26, 2022, the CBN Governor, Mr. Godwin Emefiele announced, to the shock of most Nigerians, that the Federal Government has approved the withdrawal of high-value banknotes, namely, the N200, N500, and N1000 denominations from circulation, to be replaced with redesigned notes in the same category. All citizens were directed to exchange the affected Naira notes for new ones, as the old notes would lose the status of legal tender by January 31, 2023.

Despite the short notice, the new notes were not available for any seamless swapping in the banking halls or other avenues. Customers who lodged old notes into their bank accounts, in obedience to the CBN order, were paid back the same old notes at the point of withdrawal. By the middle of December 2022, when the new note finally showed up, they came in trickles.

Only the CBN authorities know how they expected to successfully swap the nearly N3 trillion they mopped up from the economy, with a miserable N300 billion or so, new notes which they printed. The logical outcome was the national embarrassment and human suffering that we have had to endure for many weeks, and counting. Businesses have collapsed. Hunger and misery have expanded their reach as law-abiding citizens who deposited their hard-earned currencies with their respective banks were unable to access the new notes to sustain their businesses and pay for daily needs.

To everyone’s pain, the cash swap has turned out to be an orchestrated plot to seize money from legitimate owners. Neither the extension of the cash swap deadline from January 31 to February 10 nor the feeble resolution of the National Council of State, had been able to ameliorate the suffering of the good people of Nigeria over the shortage of cash to oil the wheel of their livelihoods.

It was in the heat of chaos that the Governments of Kaduna, Kogi, and Zamfara states took the commendable step to approach the Supreme Court, via a motion ex parte, to determine if the Federal Government, acting through its agent, the CBN, had fully complied with the provisions of the Constitution and all extant laws in the way and manner it implemented the cash swap policy.

Among other prayers, the three states asked the apex court to determine “whether the 3-month Notice given by the Federal Government of Nigeria through the Central Bank of Nigeria under the directive of the President of the Federal Republic of Nigeria, the expiration of which the old Bank Notes shall cease to be a legal tender, satisfies the provision of Section 20(3) of the Central Bank of Nigeria Act 2007 which specifies that ‘Reasonable Notice’ be given by the Central Bank of Nigeria before it can call in banknotes and after which same cease to be legal tender.”

Upon the receipt of the suit, the Honourable Justices of the Supreme Court asked the Federal Government and its agent, the CBN, to suspend the demonetization of the old high-value Naira notes pending the determination of the suit. The court fixed Wednesday the 15th of February for the parties to argue their cases.

The hope of helpless Nigerians, as it seems, lies with the Supreme Court. Nigerians must believe in the justices of the court to deliver justice and reject false claims that the case is already settled.

*Ogbuagu writes from Victoria Island, Lagos

Join the Conversation